There are a lot of obvious benefits to taking on temp work during tax season — such as gaining experience and sharpening your skills while building invaluable professional relationships. Plus, temp jobs are a smart way to get a taste of a company’s workplace culture before signing on permanently. Whatever your reason for taking advantage of a seasonal opportunity, here are three things to keep in mind when working a temp job during the busiest time of year — tax season.

Practice as a temp makes for perfection later on

For recent college graduates, temp work during tax season is a great opportunity to put those four years of classroom learning into practice. For instance, a temporary gig at a tax office can allow an inexperienced candidate to shadow a seasoned accounting professional. At the same time, these candidates can build critical soft skills such as communication, problem-solving and client service. To make the most of a seasonal opportunity, start by identifying and playing on your strengths — something management is bound to take notice of. If you can make a positive impression every day, you never know what other opportunities will be waiting around the corner.

Stay current on the latest trends

Tax companies are looking for quality temporary workers with the right backgrounds and skills to contribute value from day one. In that context, what should you do to be a standout candidate?

One easy answer: come prepared. For starters, staying abreast of recent tax law revisions, such as the Tax Cuts and Jobs Act (TCJA), can be a huge advantage, as many tax offices are still wrapping their heads around the seemingly infinite pages of fine print. Not to mention, companies are still catching up on delays from the recent government shutdown. These and other factors affect the way taxes will be prepared this year, so having a nuanced understanding of them will help set you apart as a candidate.

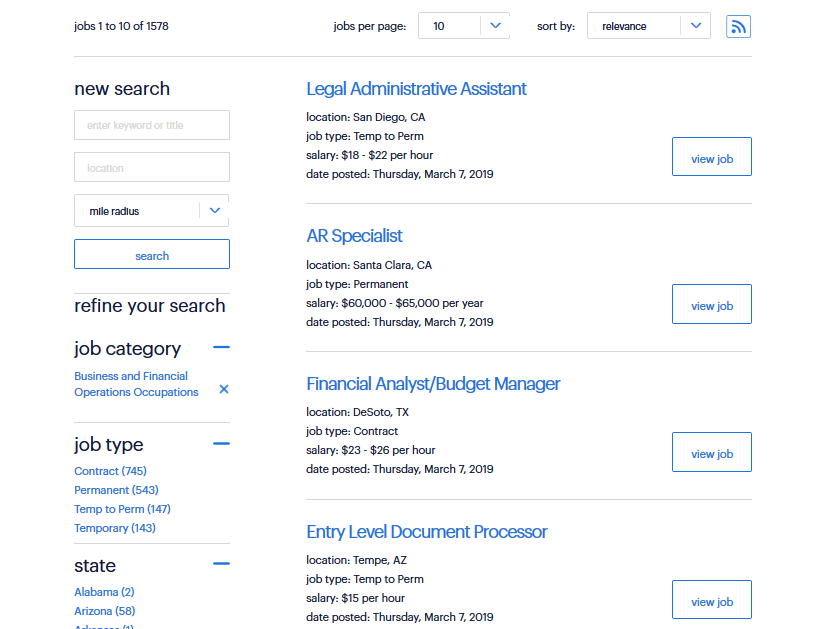

Job opportunities abound

There are more job openings than job seekers in the U.S. today — and within the finance and accounting sector alone, headcount is expected to increase by 2.3 percent in the coming year. That means opportunities should be plentiful. Use this time to gain experience, explore different workplace environments and ultimately find the culture that’s the right fit for you.

You also might consider working with a staffing and recruitment firm, as they can best match you to quality, contract opportunities based on your skill set and interests. They’ll already have a few in-demand options lined up, which can save you a lot of time and effort in the process.

Temp work is an opportunity to develop valuable skills, gain experience and expand your professional network. So this tax season, treat temporary gigs as the great opportunities there are — and you’ll find that you’re well positioned for success in 2019 and beyond.

==========

About Jodi Chavez, Group President, Randstad Professionals, Randstad Life Sciences and Tatum

Jodi oversees the field organization and provides strategic direction for Randstad Life Sciences, Randstad Professionals and Tatum. With more than 20 years’ experience in the staffing industry, Jodi’s entrepreneurial drive and strong business acumen have enabled her to consistently increase revenues, grow profits and deliver ROI. Her breadth of expertise spans team building, strategic planning and execution, M&A, branding, social media and multi-generational leadership.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs